- Personal Income Tax South Africa

- Gambling Tax South Africa 2017 News

- Gambling Tax South Africa 2017 Full Video

While online gambling in South Africa is still seen as being a grey area, it is nevertheless possible to place bets at land-based casinos, as well as 2020 online betting sites with gambling licenses issued by the National Gambling Board. Again, any winnings accrued at these venues are not subject to any kind of tax, gambling online or otherwise.

- Nov 16, 2017 Corporate tax in South Africa is set at a flat rate of 28% for all companies. Although a withholding tax on winnings has been proposed since 2011, nothing has been set in stone. Software Testing and Online Gambling Any machine or device which needs calibration or certification must be tested by a licensed testing agent.

- May 30, 2017 The NGB can be contacted on 010 003 3475 and for any further information at www.ngb.org.za. Information relating to any suspected illegal gambling activity in South Africa can be provided to the NGB at fraudalert@ngb.org.za.

NGB Goes Up Against Online Casinos &Cryptocurrency

In South Africa, online casinos are still causing the National Gambling Board headaches, and emerging crypto-currencies are just adding fuel to the fire says Caroline Kongwa. Kongwa is the NGB Accounting Authority, and she made this statement over the course of a two-day conference in Pretoria, Gauteng, over the 18th and 19th of July.

Casino hopper biloxi costume. CTA's popular Casino Hopper is a fixed route that serves the casinos, attractions and businesses on Hwy 90, Caillavet Blvd., and Bayview Ave. On the Biloxi Loop. The Casino Hopper provides service every 25 minutes, Monday thru Sunday. Hop aboard and have fun! Casino Hopper – Now Hopping every 25 minutes 7-day a week! It is low cost of $1 per ride and goes to the Imperial Palace, Boomtown Casino, the New Palace Casino, the Beau Rivage, the Hard Rock Casino, the Grand, the Isle of Capri, the Casino Magc, O;'Keefe Museum, the Biloxi Regional Medical Center, Town Green, and will make stops all throughout Beach Blvd. A picture below and right here.

Winnings Confiscated

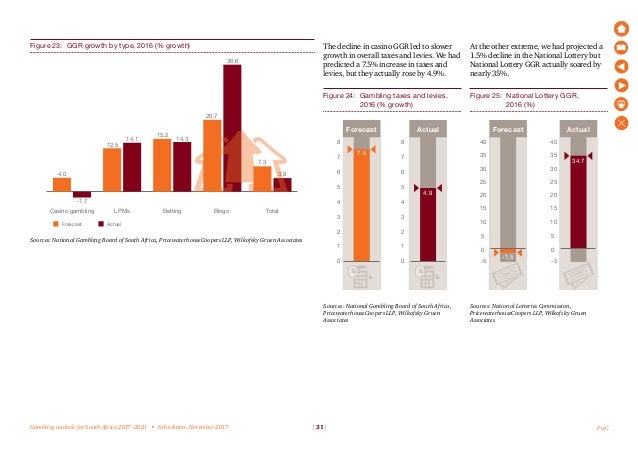

The issue hasseen the NGB and South African Police Service raiding illegal online casinos,with the Department of Trade and Industry confiscating R1.25 million worth ofwinnings in 2017. The board has revealed that illegal online activities areeroding revenue generated by the legal betting industry. It noted thatoperators are creating games that compete with what has traditionally beenoffered, and this has had a detrimental impact on formal betting.

Kongwa statedthat this impacts the government's tax revenue ultimately, which then resultsin a loss of employment opportunities, a decrease in local economic activity,and consumer rights and protections being eroded.

International Operators are Problematic

Online gambling includes Poker games, traditional casino games like Roulette and Blackjack, and sports betting, and these options have been available since 1994. Although many countries restrict online betting or ban it altogether, it has been legalised in certain Canadian provinces, the majority of the European Union, and several Caribbean nations.

Kongwarevealed that online operators continue to offer their services in South Africadespite not being strictly legal. The only lawful route for South Africans isbetting through licensed bookmakers who have the proper permits to offerwagering on sports events and horse races. Citizens are not able to gamble withunlicensed international operators.

Personal Income Tax South Africa

Serious Consequences for Law-Breakers

Gambling Tax South Africa 2017 News

The issue hasseen the NGB and South African Police Service raiding illegal online casinos,with the Department of Trade and Industry confiscating R1.25 million worth ofwinnings in 2017. The board has revealed that illegal online activities areeroding revenue generated by the legal betting industry. It noted thatoperators are creating games that compete with what has traditionally beenoffered, and this has had a detrimental impact on formal betting.

Kongwa statedthat this impacts the government's tax revenue ultimately, which then resultsin a loss of employment opportunities, a decrease in local economic activity,and consumer rights and protections being eroded.

International Operators are Problematic

Online gambling includes Poker games, traditional casino games like Roulette and Blackjack, and sports betting, and these options have been available since 1994. Although many countries restrict online betting or ban it altogether, it has been legalised in certain Canadian provinces, the majority of the European Union, and several Caribbean nations.

Kongwarevealed that online operators continue to offer their services in South Africadespite not being strictly legal. The only lawful route for South Africans isbetting through licensed bookmakers who have the proper permits to offerwagering on sports events and horse races. Citizens are not able to gamble withunlicensed international operators.

Personal Income Tax South Africa

Serious Consequences for Law-Breakers

Gambling Tax South Africa 2017 News

Presently,the gambling industry, except the National Lottery but including otherlotteries like society lotteries, promotional competitions and sports pools, isunder the regulation of the NGB. It is also subject to the 2004 NationalGambling Act. Kongwa said that, in light of online gambling being illegal inSouth Africa, operators face severe consequences if they're caught offeringunlawful games, and gamblers could see their winnings being confiscatedentirely.

Kongwa went on to say the gamblers could also face prosecution for taking part in illegal activities. She went on to say that the Department of Trade and Industry took the National Gambling Amendment Bill to parliament in 2018, and this recommended no new forms of betting be allowed. It also included several improved provisions regarding legislation to deal properly with illegal gambling. Wing slots and slats.

Gambling Tax South Africa 2017 Full Video

The proposedbill suggested provisions should be included which forbid illegal winnings,along with amendments to ban Internet service providers, banks, and otherpayment facilitators from smoothing the way for unlawful activities to occur.This bill would also cover the transferal, payment, and promotion of payment ofillegal winnings to South Africans.

Thisprohibition will require extreme vigilance by the NGB in terms of alertingvarious institutions to illegal operations. If this notification fails to beimplemented, the affected body or institution will be criminally liable interms of the Act, and any winnings could be added to the Unlawful WinningsTrust.